5 juniors set to jump on graphene bandwagon

Graphene is billed as the thinnest, strongest, and most malleable material ever developed, and experts are abuzz over its potential uses in electronics, biological engineering and other industries. But graphene comes from graphite, a mineral with a global production of just 1.1mtpa. Here are five Australian juniors poised to jump on the booming demand for graphite, which could be just around the corner.

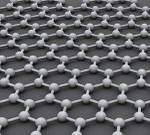

First developed at the University of Manchester in 2004, graphene is a one atom thick, near-transparent sheet of graphite. It is 100 times stronger than steel, and conducts both heat and electricity with great efficiency.

Ten years on from its development, however, graphene is not used in commercial applications. But experts are sure the material will play a big role in future technology, with potential uses in medicine, electronics, desalination, molecular science, energy storage and production, and dozens of other industries, and a number of companies and research units are working feverishly to develop one or more such uses.

If (or when, if most experts on the subject are right) demand booms for graphene, so too will the demand for its precursor, graphite. Even without a massive boom, graphite demand is expected to rise to 2.6mtpa by 2020.

Australia isn’t currently a player on the international graphite stage. In April, Valence Industries became the first Australian business to sell graphite in the past 20 years, after re-opening its Uley Graphite Mine in South Australia – the country’s only graphite mine – in January.

There is graphite to be mined in Australia, though, and there are plenty of junior miners working towards graphite mines of their own, all around the country. There are also Australian juniors with substantial graphite prospects overseas. Here are five to keep an eye on:

Lincoln Minerals (ASX: LML)

Lincoln Minerals’ graphite prospects lie on the eastern portion of South Australia’s Eyre Peninsula, within spitting distance of Port Lincoln, on the Spencer Gulf.

The company, which is focused on both graphite and iron ore mining at its various South Australian tenements, was listed on the ASX in March 2007, and is currently worth 5c per share, with a market capitalisation of $13.4m.

Its flagship project, Kookaburra Gully Graphite, holds a JORC Mineral Resource of 2.2mt grading 15.1% total graphite carbon (TGC) – an assessment the company says makes Kookaburra Gully one of the world’s top ten graphite resources by grade. The junior says the immediate area around that resource has the potential for between 15mt and 40mt of further resources.

A scoping study saw Kookaburra Gully as a 200,000tpa graphite mine, which would cost around $38m to develop. Once operational, Lincoln says it could produce graphite concentrate at a cost of $360/tonne.

Lincoln’s grade of graphite is currently priced around US$1,250/tonne.

Lincoln is also exploring other resources in the area, including the Koppio Graphite Mine (an historic mine), Campoona Syncline, Gum Flat and Sleaford Mere. Several of its resources hold promise in iron ore production, but the company holds graphite as its main focus.

More: www.lincolnminerals.com.au

Buxton Resources (ASX: BUX)

Buxton’s maiden drilling program at its Yalbra Graphite project in the central-west of WA intersected numerous zones of high-grade graphite, with a JORC Code Inferred Resource of 2.27mt @ 20.1% TGC shown.

As a result, Buxton commenced an RC and diamond drilling program in March, designed to extend the existing resource, to facilitate a scoping study by upgrading the majority of the existing Inferred resource to an Indicated one, and to undertake resource and metallurgical test-work.

The Yalbra project comprises tenements which together cover 473km2. Buxton believes it is the highest reported grade graphite resource in Australia.

Buxton has a number of other projects in development, but they are mostly focused on nickel, copper and other commodities other than graphite. Its 25c share price translates to a market capitalisation of around $13.4m.

More: www.buxtonresources.com.au

Archer Exploration (ASX: AXE)

Archer Exploration is an explorer with more than 10,000km2 of tenements in its portfolio. It is focused on discovering graphite, magnesite, manganese, copper, gold and uranium.

Its key graphite project at the moment is the Campoona Project, on the Eyre Peninsula in SA. Campoona has a JORC Resource of 5.27mt @ 7.6% TGC, which also measures as a 2.53mt JORC Resource @ 12.3% TGC.

The trick with Campoona, however, is the quality of the product. While graphite grading at around 90% purity sells for around US$1,200, graphite as pure as 99.95% can sell for as much as US$30,000/tonne.

And Archer says its flotation tests have shown a high grade of graphite could be produced from Campoona.

“Campoona is unique in that it can deliver very high quality graphite from a low cost, high yielding extractive process,” Archer says on its website. “Metallurgical bench-scale testing of representative diamond drill core samples of Campoona graphite has resulted in recoveries of >99% TGA (total graphitic carbon completed using thermogravimetric analysis accurate to +/- 1% carbon).”

On May 21, Archer conditionally agreed to buy an additional graphite prospect belonging to fellow junior miner Monax Mining, known as the Waddikee project. Covering an area of 999km2, Waddikee – in Archer’s words – is “highly prospective for graphite, manganese, iron (magnetite and hematite), gold, base metals (Ag-Pb-Zn-Cu) and uranium”.

“Waddikee hosts a number of graphite deposits and prospects that have been evaluated using combinations of geophysics (airborne magnetic and electromagnetic surveys), rock chip sampling, detailed petrology and drilling,” the company added.

More: www.archerexploration.com.au

Triton Minerals (ASX: TON)

Looking offshore, ASX-listed junior Triton Minerals just yesterday hit an “enormous” graphite intercept at Nicanda Hill, its graphite prospect which is part of its Balama North project in Mozambique. Balama North is located alongside Syrah Resources’ Balama East project – renowned as the largest known graphite deposit on earth.

Triton’s latest drilling results have shown a 316m graphite mineralisation intercept on a single hole at Nicanda Hill.

“This diamond drill hole has again confirmed the world class potential of the Balama North project,” said managing director Brad Boyle. “To intercept an astounding 316m cumulative width of graphite mineralisation in a single drill hole and this mineralisation remains open at depth is a very exciting result.”

A JORC Resource report for Nicanda Hill is anticipated early next year.

More: www.tritonmineralsltd.com.au

Syrah Resources (ASX: SYR)

Boasting a market capitalisation of $576.3m, Syrah Resources is by far the biggest name on this list – and rightly so. The ASX-listed junior has been working away for several years now at its Balama project in Mozambique, which it says is the world’s largest known deposit of high grade graphite.

Syrah says Balama holds 1.15bn tonnes of graphite resource at 10.2% TGC – meaning it contains roughly 117mt of graphite – a “larger resource than the rest of the world’s reserves combined.”

Balama also holds one of the world’s largest deposits of the chemical element vanadium, which is used primarily as a steel additive to make strong steel alloys, for things like tools and surgical instruments.

Syrah is preparing Balama for development, and has already signed a Memorandum of Understanding with Asmet, a UK metals trader, for offtake of 100,000 to 150,000 tonnes of graphite per annum, at a price of approximately US$1,000/tonne.

A second MoU for 80,000 to 100,000 tonnes of graphite per annum is in the works with Chalieco, a Chinese engineering firm. Syrah says it is being approached by a number of Chinese graphite buyers, as China’s Helionjiang Province has announced plans to shut down polluting graphite mines. China is the world’s biggest graphite producer.

Source from here