Cost cutting, iron ore buoyancy reap profits for Rio, BHP and FMG

Australian mining’s big three – Rio Tinto, BHP Billiton and Fortescue Mining Group – all recorded impressive profit increases for the end of 2013, while British multinational miner Anglo American isn’t where it wants to be.

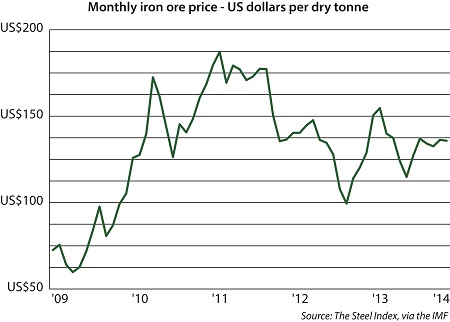

An iron ore price that stayed higher and more stable than some predicted, and increased shipment volumes were the key factors for Australia’s big three miners in the back end of 2013.

“These strong results reflect the progress we are making to transform our business” – Rio Tinto chief executive Sam Walsh.

For the pair of miners once known as the ‘big two’, BHP Billiton and Rio, cost cutting was also key.

BHP, which on February 18 released its results through the first half of the 2013/14 financial year (i.e. the six months ending December 2013), recorded a 65% increase in net operating cash flow and a 25% reduction in cash outflows on the way to a 31% rise in profit, to $8.66bn.

Rio, which announced its full-calendar-year 2013 results five days before BHP released its half-financial-year figures, also tightened its belt on the way to a healthy profit.

Rio reported net earnings of $4.07bn through the full 2013 calendar year – a massive turnaround from its net loss of $3.36bn in 2012.

And FMG, once the little brother, romped further into national relevance, turning a profit of $1.9bn in the second half of 2013. That represented an increase of 260% on the $530m earned in the second half of 2012.

Productivity the magic word for BHP

BHP Billiton, reporting on the first half of the 2013/14 financial year, boasted a profit of $8.66bn, more than 30% higher than in the first half of 2012/13.

Chief executive Andrew Mackenzie said the strong performance was driven by a substantial improvement in productivity and additional volume from the company’s largely brownfield investment program.

“The commitment we made 18 months ago to deliver more tonnes and more barrels from our existing infrastructure at a lower unit cost is delivering tangible results,” Mackenzie said.

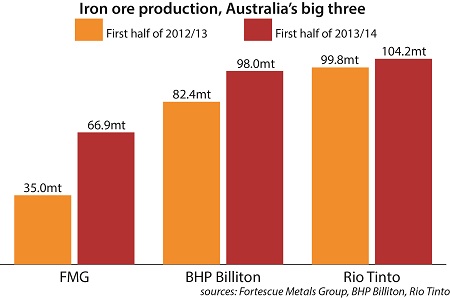

BHP’s Western Australian iron ore operation produced 98mt of iron ore in the first half of 2013/14, up 19% year-on-year.

The miner was also helped by an unprecedented production rate for its coal operations in Queensland, which saw an annualised production rate of 68mtpa achieved in December.

Copper production also increased, by 6%.

But the real advantage came for BHP, Mackenzie said, in productivity.

“Annualised productivity led volume and cost efficiencies totalling US$4.9bn are now embedded and this is expected to increase to US$5.5bn by the end of the 2014 financial year,” he said.

“This sustainable increase in productivity supported a 9% increase in the group’s underlying EBIT margin to 38% and a strong improvement in the group’s underlying return on capital to 22%.”

Mackenzie, who took over as chief executive following the departure of Marius Kloppers in May 2013, said he intended to make the most of a culture of internal competition, between different divisions of BHP.

“The group’s opportunity-rich portfolio remains a key point of differentiation,” the Scottish ex-pat said. “By maintaining strict financial discipline and increasing internal competition for capital we intend to further differentiate ourselves by creating a more capital efficient organisation.”

Mackenzie finished by recognising BHP’s safety record for the December 2013 half year.

“We are pleased to report improved safety performance in the first half, reducing our total recordable injury frequency to a record low of 4.4 per million hours worked,” he said.

Cost cutting leads Rio back to black in 2013

Rio Tinto slashed 4000 jobs in 2013, to turn a profit of more than $4bn.

New chief executive Sam Walsh led a cost-cutting drive in an effort to turn around a net loss in 2012 of over $3bn, which was influenced heavily by around $15bn in write-downs.

Reporting on the full 2013 calendar year, Walsh was pleased with the miner’s newfound prudence, but was also determined to maintain it.

“These strong results reflect the progress we are making to transform our business,” Walsh said. “[The results] demonstrate how we are fulfilling our commitments to improve performance, strengthen the balance sheet and deliver greater value for shareholders.”

Walsh said Rio had achieved underlying earnings of $10.2bn (10% higher than in 2012), exceeded its cost reduction targets and set production records.

“In turn, this has enhanced our cash flow generation and lowered net debt,” he said. “The 15% increase in our dividend reflects our confidence in the business and its attractive prospects.”

Rio saved $1bn in exploration and evaluation cuts, exceeding its target of $750m in savings.

It also set production records in the 2013 calendar year for iron ore (209mt), bauxite (43.2mt) and thermal coal (23mt), and saw a strong recovery in copper volumes, which were up 15% in terms of mined copper, and 7% in terms of refined.

In the second half of 2013, Rio produced 104.2mt of iron ore in Australia, an increase of 4.4% year-on-year.

Fortescue heads towards target capacity with big first half

Just nine years on from its listing on the ASX, Fortescue Metals Group is now storming towards its target sustainable capacity of 155mtpa, mining 66.9mt of iron ore in the first half of 2013/14, and shipping just under 54mt out of the country during that period.

Those figures represent a 91% increase in terms of mined ore, and a 51% increase in terms of shipped ore, on the first half of the previous financial year.

The production increase came with just a 20% rise in the amount of overburden removed, reflecting the introduction of Solomon ore, and a decrease in strip ratios at the Chichester hub, FMG explained.

But the big story for FMG is the activation of its new infrastructure, which is now set to export ore at the company’s target capacity.

“Rail and port operations are fully ramped up with the port operating at 115mtpa outload run rate for an extended period during December 2013,” the company’s directors said in a joint report.

The first iron ore from FMG’s Kings deposit was delivered in November 2013, adding to the company’s production drive.

“Fortescue is in the final stages of completion of the 155mtpa expansion program announced in October 2010,” the Andrew ‘Twiggy’ Forrest-led board of directors explained. “Port and rail have demonstrated the capacity and efficiency of the new infrastructure with the fourth berth, a surge bin and the third ship-loader now fully integrated into port operations.”

Production and shipment improvements translated into a fantastic year financially for the growing iron ore miner.

FMG’s revenue in the first half of 2013/14 was up 77% to $6.5bn, its EBITDA was up 184% to $3.6bn, and its net profit after tax was up 260% to $1.9bn.

Anglo American ‘not where we want to be’, CEO says

Chief executive of British mining conglomerate Anglo American, Mark Cutifani says the company is “not anywhere near where we need to be as a group,” after the company announced a loss of $1.07bn in the 2013 calendar year.

Despite that figure, though, Anglo is reporting an underlying profit for 2013 of $6.6bn, an increase of 6% from 2012, and one that Cutifani calls “encouraging.”

That underlying figure, according to Anglo, discounts special items and remeasurements, and includes the group’s attributable share of associates’ and joint ventures’ operating profit.

Underlying earnings were down for Anglo, 7% to $2.97bn, despite the increase in underlying operating profit.

“The results from our point of view are encouraging but certainly not where we want to be,” Cutifani said in a conference call on February 14. “So there are some encouraging signs in terms of business improvement and in particular improvement in the second half and in particular the fourth quarter.

“We’re not anywhere near where we need to be as a group and certainly there is a lot of work to be done.”

All figures are in Australian dollars, unless otherwise noted.

Source from: here